Before choosing a profit-sharing plan or a 401(k), it’s important to understand what they are. All retirement plans are profit sharing plans. A profit-sharing plan is one where the employees don’t make contribution and the employer has the option to make...

Before choosing a profit-sharing plan or a 401(k), it’s important to understand what they are. All retirement plans are profit sharing plans. A profit-sharing plan is one where the employees don’t make contribution and the employer has the option to make...

Before choosing a profit-sharing plan or a 401(k), it’s important to understand what they are. All retirement plans are profit sharing plans. A profit-sharing plan is one where the employees don’t make contribution and the employer has the option to make...

Before choosing a profit-sharing plan or a 401(k), it’s important to understand what they are. All retirement plans are profit sharing plans. A profit-sharing plan is one where the employees don’t make contribution and the employer has the option to make...

The following infographic illustrates how entrepreneurs can use their qualified retirement plan to purchase or recapitalize a business/franchise, tax-deferred and penalty-free. Highlights include the 4-step process of using a ROBS (Rollover as Business Startup) and...

The following infographic illustrates how entrepreneurs can use their qualified retirement plan to purchase or recapitalize a business/franchise, tax-deferred and penalty-free. Highlights include the 4-step process of using a ROBS (Rollover as Business Startup) and...

With unemployment rates falling to a level around 5.6%, some people are considering putting their dreams of franchise or business ownership on hold for the perceived security of a real job. If this describes your current situation you don’t need to let this...

With unemployment rates falling to a level around 5.6%, some people are considering putting their dreams of franchise or business ownership on hold for the perceived security of a real job. If this describes your current situation you don’t need to let this...

When you decided to open your own business, you probably envisioned a successful venture doing something you love. You probably did not envision being immersed in paperwork, such as payroll and benefit administration. Many small business owners, in an effort to save...

When you decided to open your own business, you probably envisioned a successful venture doing something you love. You probably did not envision being immersed in paperwork, such as payroll and benefit administration. Many small business owners, in an effort to save...

There is little wonder why some small business owners are concerned when reading headlines such as “Is the Taxman Coming for Retirement Entrepreneurs,” or “Warning Shots-Tax Court Takes Aim at Retirement Rollovers as Funding Tool.”...

There is little wonder why some small business owners are concerned when reading headlines such as “Is the Taxman Coming for Retirement Entrepreneurs,” or “Warning Shots-Tax Court Takes Aim at Retirement Rollovers as Funding Tool.”...

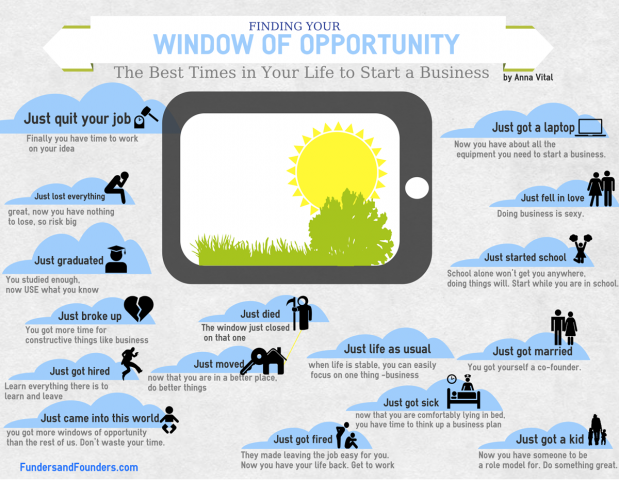

We came across this interesting infographic on Finding Your Window of Opportunity – The Best Times to Start a Business (from Funders and Founders): With summer being the season of adventure, it’s also the perfect time to let go of any excuses and start on the...

We came across this interesting infographic on Finding Your Window of Opportunity – The Best Times to Start a Business (from Funders and Founders): With summer being the season of adventure, it’s also the perfect time to let go of any excuses and start on the...