The U.S. Small Business Administration (SBA) offers an array of loans designed to give entrepreneurs a boost when starting or growing their businesses.

These loans feature favorable interest rates, extended payback terms, and flexibility in use of proceeds. With the myriad types of loans available and complex applications, many small business owners turn to an SBA loan specialist like Benetrends to help them navigate the process.

As seen in the recent post, SBA Loans: What They Are and How to Get Them, understanding SBA loan types is an important step. Here is a look at the most common SBA loans, their criteria, uses, interest rates, and details.

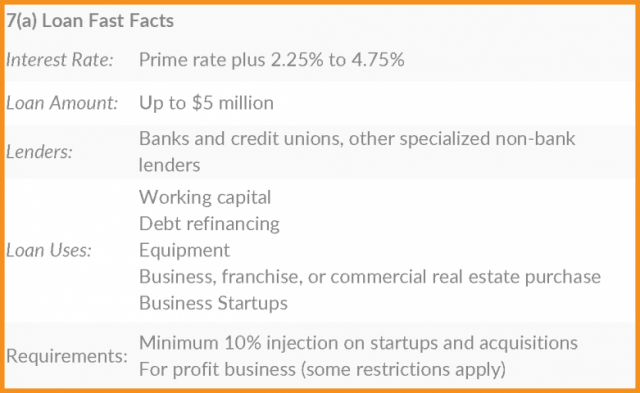

7(a) Loans

These are the most popular SBA loans and provide the lender with a high degree of flexibility in their use. They are especially helpful for business owners who need working capital.

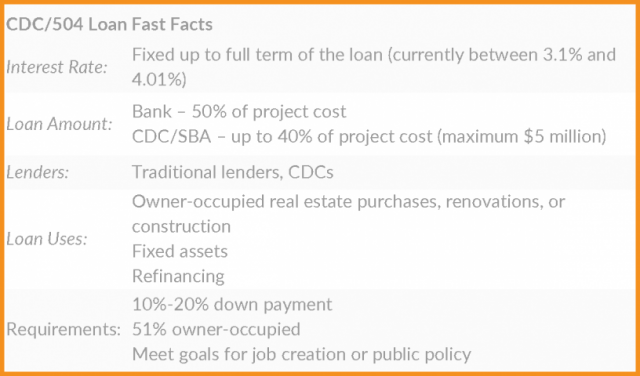

CDC/504 Loans

This is the SBA’s version of a commercial real estate loan, though it can be used for some other purposes. The borrower’s business must occupy at least 51 percent of the space. The program involves two loans. The primary loan from a traditional lender (50%), a secondary loan from a Certified Development Company (40%) and the balance as cash injection from the borrower (10%).

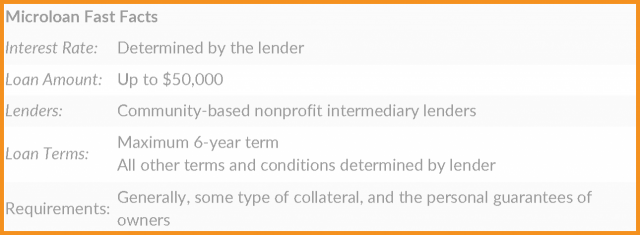

Microloans

For business owners who need small amounts of cash, microloans are a smart option, with repayment terms up to 6 years. Unlike other SBA loans, microloans are not guaranteed by the agency.

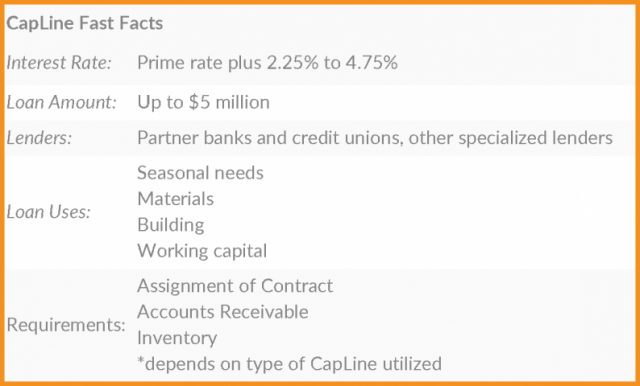

CAPLines

This is the SBA’s version of a line of credit, providing short-term capital. There are four types of CAPLines to help businesses with:

- Seasonal increases in inventory, labor, or accounts receivable

- Materials and labor for assignable contracts

- Contractors and home builders

- Converting short-term assets (e.g. pending invoices) into cash

Understanding the differences between SBA loan types and how to navigate the application process is a Benetrends specialty. With over 35 years of experience with small business funding, Benetrends has the experience and expertise to help you select and apply for the loan that works best for your business. Schedule a consultation to learn more.