There is little wonder why some small business owners are concerned when reading headlines such as “Is the Taxman Coming for Retirement Entrepreneurs,” or “Warning Shots-Tax Court Takes Aim at Retirement Rollovers as Funding Tool.”

Unfortunately, the articles are misleading and are causing undue fear and concern, often where none is warranted. The articles are addressing two tax court cases (Peek v. Ellis) that deal with the misuse of self-directed IRAs and do not pertain to rollover as business startups (ROBS) arrangements.

Benetrends’ Founder and Chairman Len Fischer, the architect of ROBS arrangements, states, “The rules are very different for self-directed IRAs. The ROBS community is not affected by (the) court decision(s).”

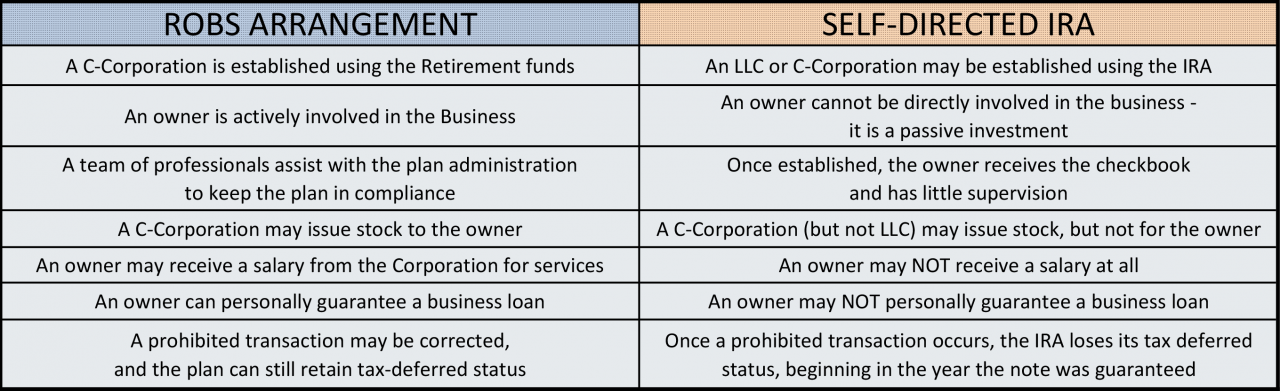

So, what are the differences between a ROBS arrangement and a Self-Directed IRA?

In Peek v. Commissioner, 140 T.C. No. 12 (May 9, 2013), the court ruled that two taxpayers engaged in a prohibited transaction when using their self-directed IRA assets to purchase a new business:

According to court documents, two Colorado taxpayers used self-directed IRA assets to help purchase a fire-safety business. In a May 9, 2013 opinion, the Court ruled that a prohibited transaction had occurred when the two taxpayers personally guaranteed a promissory note to the seller as part of the purchase of the business.

The Court’s opinion was based on the prohibited transaction rules found in ERISA and the Internal Revenue Code. According to the court case, the personal guarantee provided by the individuals was considered to be an indirect extension of credit by the taxpayers to the corporation which was owned by the IRAs.

In Ellis v. Commissioner, T.C. Memo. 2013-245 (October 29, 2013), the court ruled against a Missouri man who used a self-directed IRA transaction to rent space for his business and pay himself a salary:

In this case, the Court addressed a couple issues related to the use of the IRA. First, is using the IRA to fund an LLC a prohibited transaction? Second, did a prohibited transaction occur when he was paid from the LLC for his services as the company manager?

The Tax Court ruled that the use of the IRA to fund the LLC was not a prohibited transaction, since the IRA and ownership of the LLC belonged to the same person. The prohibited transaction occurred when the IRA was used for compensation. The IRA cannot pay the IRA owner (or any other disqualified person) compensation for managing the LLC. The decision was affirmed by the US Court of Appeals, Eighth Circuit on June 5, 2015.

Consequently, in both cases, the courts ruled that the IRAs lost their tax-deferred status beginning in the year the note was guaranteed, resulting in the taxpayers being required to pay capital gains tax, with penalties and interest on the proceeds from the eventual sale of the company.

These cases emphasize the importance of using experienced professionals to ensure that the process is compliant. And, if an error occurs, taking the correct steps in the right sequence is paramount.

About Benetrends:

Benetrends has been at the forefront of developing ROBS plans without tax penalty. Our 35-plus years of experience and expertise, along with our plan guarantee, provide our clients with peace of mind and confidence to pursue their dreams of business ownership.

If you’re ready to start your own business, schedule a consultation, or see if you pre-qualify.